In this article GCG Asia Withdrawal looks at robo-advisories, a fintech service that’s becoming legitimately more and more popular in Asia, also known as Digital Investment Management services.

Robo-advisories – also known as automated or digital investment services– utilise modern software and algorithms to create and manage your investment portfolio. Services vary from automatic recalibration to tax optimisation, and little or no human contact is required. However, services often have online consultants or contact with customer service available.

Often traditional portfolio management services need significant balances; robo consultants generally require modest fees or no fees at all. Due to this and its low expenses, robo-advisories allow you to begin investing fast – in many cases within minutes.

Investing can be difficult. While there’s no shortage of information on the subject, many people find the process overwhelming. They fear they won’t have the knowledge or skills required to succeed. Robo-advisers can help. Simply put, they are cost-conscious individuals who dedicate their lives to helping others achieve financial freedom. As human beings have been investing in things for hundreds of years, many reasons exist as to why someone might want to seek out automated investment advice.

GCG Asia Reviews Low Withdrawal Fees in Robo Advisories

GCG Asia Withdrawal advisors explain that robo-advisors are significantly cheaper than a human financial consultant. Many businesses charge an annual administration charge of between 0.25% and 0.50%, however free solutions do exist as well. Like many other financial consultants, the costs of your assets are a percentage of the assets you have invested. The fee is usually paid monthly or quarterly from your account. Usually, you won’t pay a robo consultant transaction charge. You can pay a commission to purchase or sell investments both in a normal brokerage account when you rebalance your portfolio and when you deposit or make a withdrawal. GCG Asia Withdrawal experts tell us that these expenses are often waived by robo-advisors.

For many investors, withdrawals are an issue to be contended with. There are many scam brokerages or investment accounts where investors are unable to withdraw their money or where the company may put up hurdles in front of you before you are able to successfully withdraw your money. GCG Asia views withdrawal issues should not be an issue with reputable robo-advisories.

Robo Advisories is arguably the most exciting investment phenomenon in the Fintech revolution. It represents the rapid development of technology in recent decades that has led to the creation of instruments that are pluripotent and adaptable. Robotic investment advising, or Robo-advice for short, is a new field of investment advisory services that challenges traditional financial models by leveraging robotics and Artificial Intelligence (AI) to help provide investment guidance to clients in a low-cost, automated way. These robotic systems are becoming increasingly autonomous and capable. AI provides an incredible advantage when applied to decision-making by identifying complex equations and identifying the best investments opportunities for the user.

You might ask yourself; How Robo-advisers leverage Artificial Intelligence and Machine Learning to identify the best assets to rebalance for clients. This is accomplished by analysing the client’s historical trading behaviour and activity, as well as historical data, feeds collected from various proprietary sources. The resulting asset allocation plan is then automatically sent to the client’s Robo-Advisor platform where it undergoes final composition and Verification before being purchased.

The best way to get started investing is to use a Robo advisor to learn about it. These advisors are designed to simplify your investing experience by collecting relevant information, putting your financial goals in perspective, and surfacing opportunities you might not have considered otherwise.

The process is simple according to GCG Asia Withdrawal experts: You register with a Robo advisor, provide them with some basic information about you and your business, and determine what investments you’re most interested in making. Unlike the traditional investment process, which relies on memory and gut feelings, investing with a robot provides a level of data-driven advice that can save you time and money in the long run.

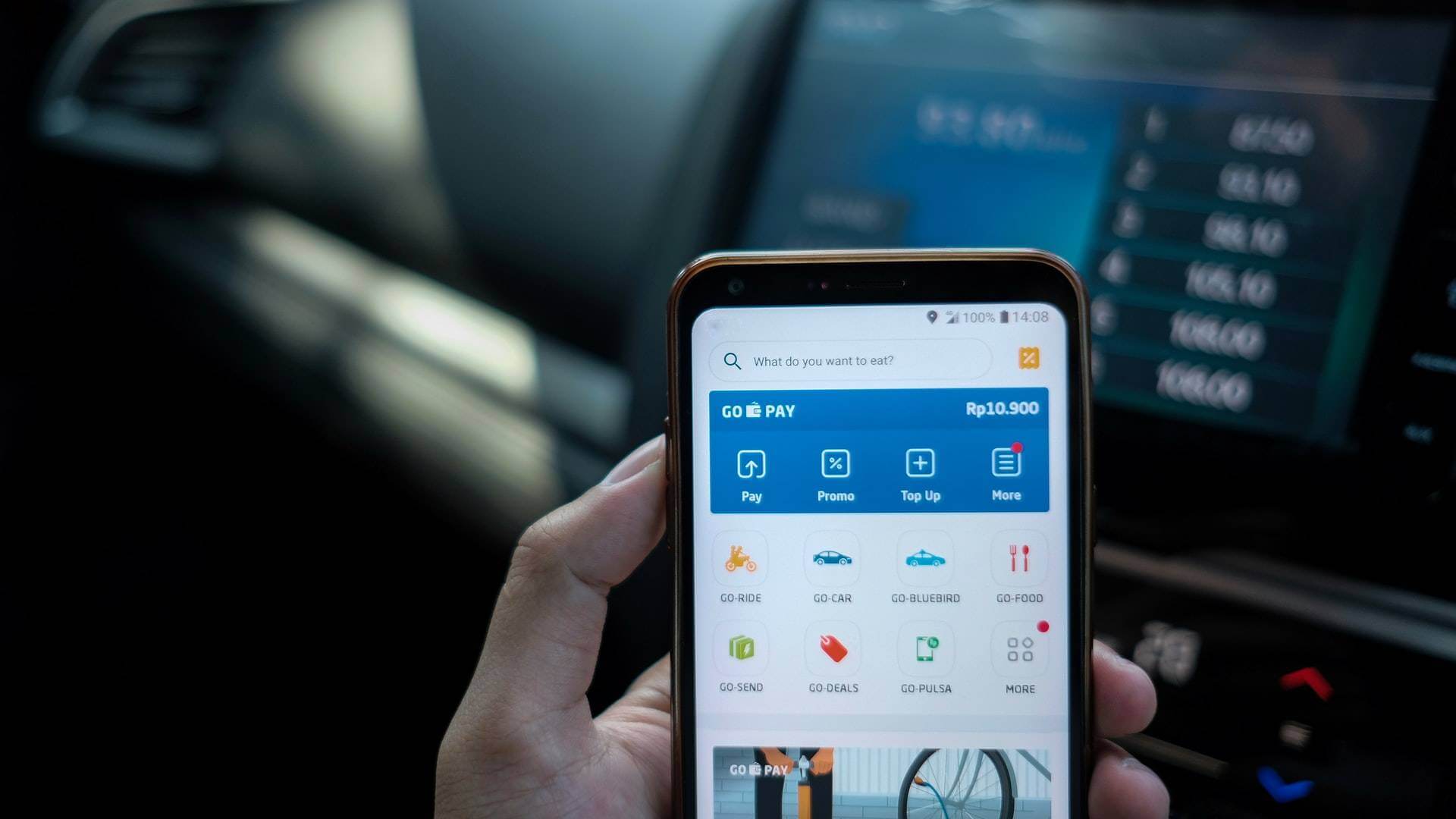

GCG Asia Withdrawal in Singapore’s Lee Cheong tells us that, to identify the best Robo advisor, consider the services they offer, their fees and how actively they engage with their clients. Some services may target specific population or age groups. Other features may be worth looking for as an average consumer. For example, Digital Assets enables you to purchase research reports online while downloaded onto your smartphone or tablet (they do not charge for research services you just pay when you use them). Though you may be able to find a cheaper advisor using traditional means that can save you money both now and, in the future, particularly where the cost of trading is concerned. While most markets are volatile and any investment entails some risk, using a Robo-advisor can potentially lead to higher returns.

How to Choose a Legit Robo-Advisor

GCG Asia advises you to consider the following before signing up.

- Google is your friend: check out whether the service is legitimate or not by seeing if it’s registered and licensed to operate where you are.

- Minimum investment requirements. Is it prohibitive for you? What’s your budget like? How much do you have to put away?

- Portfolio recommendation. When you join up for a robo-consultant, your first contact is generally always a survey to evaluate the risk tolerance, goals and preferences for your investment. On average, robotic consultants provide 5 to 10 portfolio options ranging from cautious to aggressive. The service algorithm will propose a portfolio that is based on your responses to these questions, but if you prefer a different alternative you should be able to veto that recommendation.You should be able to veto that recommendation if you’d prefer a different option.

- Investment selection. Robo-advisors are primarily constructing their portfolios from ETFs, which are investment baskets that replicate the behaviour of an index. In addition to the management cost of the robo consultant, you will pay the fees paid for the funds, called expense ratios.

- Withdrawal issues: GCG Asia advises people to google to check whether your robo advisor has had any complaints with withdrawal of funds.

We have noticed at GCG Asia Withdrawal that the arrival of Robo-advisers has raised hopes that soon investors will be able to offer personalized investment advice. This would bring an important step toward solving one of the major problems facing the investing public today: lack of access to competent investment advice. Although Robo-advisors have some promise in this area, GCG Asia Withdrawalraises suspicion that there are troubling limitations that need to be understood over the short term before Robo-advisors can make a meaningful impact on investors.

On the other hand, GCG Asia Withdrawal in Malaysia tells us one of the biggest stumbling blocks to getting started with Robo-advice is making sure you understand exactly what you’re getting into. While the technology exists to automate a large amount of traditional financial activity, the implementation is not yet complete. You will likely make mistakes when dealing with Robo-advisors due to your lack of knowledge in this area. Making these kinds of investment decisions requires a level of knowledge that simply isn’t available through a Robo-advisor. That is why GCG Asia Withdrawal recommends gaining more knowledge on the subject.

At GCG Asia Withdrawal we found that Integrating user preferences, behavioural indicators and other relevant information into financial products is challenging, as a result, investors preferred safe, predictable assets where they knew the management would act in their best interests. This led to an explosion in investment services offered by firms providing Robo-advisors.

Investor passivity has had its positives and negatives. On the one hand, it can enable more efficient and thoughtful investment decisions. On the other hand, it can lead to ineffective or misguided strategies that sacrifice short-term gains for longer-term goals.

Moreover, GCG Asia Withdrawal experts find it crucial to have some knowledge in finance before investing in Robo-advisors or going to the stock market because anyone can open an investment account with a financial institution. What matters is whether the individual is prudent in his or her use of the funds. GCG Asia Withdrawal experts recommend assessing everything by asking several questions, including whether the saver has a track record for good investment habits, whether he or she can afford to lose money when investing, and whether the institution is reputable. The answers to these questions help the investor determine whether or not an institution is a good place for his or her money.

GCG Asia Withdrawal argues that the financial industry has been fighting a losing battle against technology for some time. As progress continues to be made in artificial intelligence and computing, we can begin to see intelligent financial services that properly educate consumers on the products they buy and how those products affect their wallets.

Robo-advisors bring powerful, personalized financial insights that are unparalleled in the banking industry. Unlike human financial advisors, these machines are designed to learn and adapt over time based on the insights of their clients. They offer quick decisions which are directly impactful on your financial wellbeing and wealth. However, GCG Asia Withdrawal warns that the rise of Robo advisors also brings several risks that need to be recognized by investors and policymakers to ensure the effectiveness and safety of this emerging technology.